Uploading Timesheets into an Open Payroll

There are two types of timesheet files that can be uploaded into an open payroll in CloudPayroll.

Both files can be uploaded once a payroll has been opened, under Payroll > 2. Enter > Upload.

File Type 1

To download this template, please go to Payroll > 2. Enter > Upload > Download Timesheet Spreadsheet.

This will download a file onto your computer for you to complete and upload. All employees in the open payroll will be listed on this file. the top employee on this file will have some example information, so do not forget to clear this before continuing.

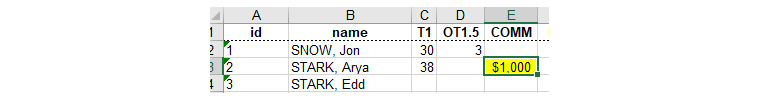

An example of a completed file will look like:

A few things to note when completing this file:

The Pay Element codes are listed along row 1. If the element you would like to upload hours/amounts against does not show, add a new row before the other column, entering the Pay Element Code in the top row.

- Right click on Column and select insert

- To find the Pay Element Code, go to Setup > Pay Element, the code will be the short code in the first column

If you are uploading an amount that needs to fill the 'Rate' field, enter a dollar symbol at the front. For example;

File Type 2

This file type does not come with a premade template, instead you create it from a blank excel sheet.

This file is formatted as follows (no heading required):

- Column A: Employees ID

- Column B: Pay Element ID (this is the Pay ID code as set up in CloudPayroll – if you log into CloudPayroll and go to Setup > Pay Elements you will see the ID codes on the left)

- Column C: Quantity (number of hours, or 1 for rate payments like bonus or commissions)

- Column D: Cost Centre (optional – required if you use costing and do not have defaults set)

- Column E: rate (optional – but necessary for payments like bonuses and commission. Hourly payments will automatically pull the base rate from the employees personal details setup)

- Column F: Leave start date (if applicable, not required)

- Column G: Leave end date (if applicable, not required)

- Column H: Notes (optional)

- Column K: Pay Periods (for bonus and commission payments only)

Related Articles

1. Open

Open a Payroll To begin processing a new payroll: Go to the Payroll > 1. Open. If required, change the date in the Date of payment field. Select the Open a new Payroll button. This article covers: Opening one or more pay frequencies Opening a one-off ...Accept Approved Timelogs in an Already Opened Payroll

Ideally, all time is recorded, submitted and approved before a payroll is open (learn about accepting Timelogs when opening a payroll). However, sometimes people will submit their time logs for approval after a payroll has already been opened. You ...Include Approved Time Logs When Opening a Payroll

Once the time logs have been Approved for a pay period, you can accept the approved time logs into a payroll. Note: You can choose to use Timelogs simply as a record keeping system, not integrated to payroll, if you do not want the time log data ...Reviewing Payroll Transactions Created From Timelogs

Whenever approved time logs are accepted into a payroll, the time logs added to each person is based on the pay element, and cost centre (if enabled). The total hours worked for each pay element, and cost centre, is added to a person's current ...Watch: Using Timelogs in Payroll